512.904.9900

Public Adjusters

Claim Assistance Available 24/7

"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

Looking For A Public Adjuster Near You? We Fight for Your Maximum Settlement.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Don’t Let the Insurance Company Undervalue Your Claim – We Maximize Your Settlement

Licensed Insurance Policyholder Advocates

500+ Satisfied Policyholders and Counting

Non-Litigious Solutions

Over $250,000,000 Recovered

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

Don’t Settle for Less — The Nations Leading Public Adjusters Are Just a few clicks away.

Looking for a Public Adjuster Near You?

Get the Insurance Claim Settlement You Deserve

Don't let insurance companies underpay your claim. Our licensed public adjusters work exclusively for YOU - not the insurance company.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

20+

Years Of Experience

500+

Large-Loss Claims Settled

130,160

Hours Worked

$450,000

Average Claim Amount

Commercial Property Claims

Residential Property Claims

Multi-Family Property Claims

Why Work With A Public Adjuster Near You?

No Recovery, No Fee Representation*

We don’t get paid unless you do.

Proven Track Record

Successfully settled hundreds of millions in property damage claims.

Avoid Unnecessary Litigation

500+ large-loss claims settled fairly & promptly.

Avoid Costly Litigation

We maximize settlements without unnecessary legal battles.

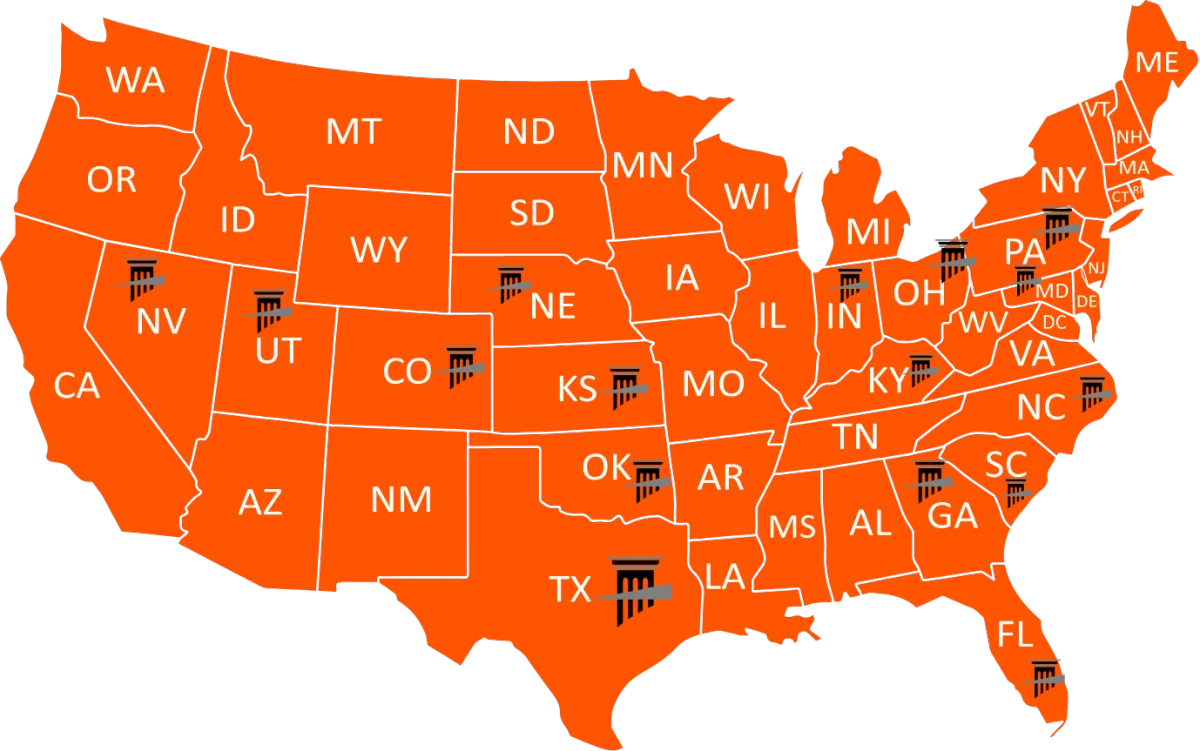

Licensed Public Adjusters Nationwide

We work exclusively for policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

"Public Adjuster Near Me"

Advocates For Policyholders

Find licensed public adjusters in your area:

Struggling With?

Initial Property Damage Claims

When a storm or fire damages your commercial, multifamily, or residential property, your first move is critical. Filing a large-loss insurance claim is high-stakes and early guidance from an ICRS public adjuster can make all the difference. By hiring our licensed insurance claim experts from day one, you avoid costly mistakes, accelerate recovery, and gain a strategic edge to maximize your settlement.

Underpaid Property Damage Claims

After a loss, you count on your insurance company to cover the full cost of restoring your property and business.

But too often, insurance claims are underpaid, leaving property owners with a financial shortfall.

We routinely represent policyholders to re-open and supplement underpaid claims.

Denied Property Damage Claims

Don't let a denial letter discourage you. Storm and fire insurance claims are often unfairly denied, leaving policyholders overwhelmed, frustrated, and unsure of what to do next.

Get a 2nd opinion before accepting a denial.

We specialize in overturning wrongfully denied property claims and fight to get the settlement you deserve.

Delayed Property Damage

Claims

Is your claim stuck in limbo? Being ignored?

Unfortunately,

delayed insurance claims are all too common and costly.

Get unstuck!

We'll push for a swift resolution and get your claim settled pursuant to your policy and statutes.

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Why Choose ICRS TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

Do you Need A Public Insurance Adjuster?

Common Concerns About Hiring a Public Adjuster

Won’t my insurance company take care of me?

While insurance companies are required to act in good faith, their adjusters work for the insurer, not for you. Their goal is to minimize payouts and protect the company’s bottom line. ICRS acts solely in your interest, ensuring your damages are fully documented, policy entitlements are enforced, and you receive the maximum settlement allowed under your policy.

Aren’t public adjusters expensive?

At ICRS, we work on a contingency fee basis—no recovery, no fee—and in most cases, our involvement leads to significantly larger settlements than what is initially offered. Clients typically find that our fee pays for itself and then some. For claims under $250,000, we offer affordable flat-rate consultations to keep costs low for smaller losses.

Will hiring a public adjuster make my claim adversarial?

ICRS professionals are trained to work collaboratively yet assertively with insurance carriers. Most insurers are used to dealing with public adjusters and often respond faster and more accurately when claims are properly documented and supported. Hiring a public adjuster simply ensures the process is fair and professionally managed, not combative.

Can’t I just wait to see what the insurer offers before hiring anyone?

By the time an offer is made, damage may be under-documented and policy deadlines may already be approaching. ICRS helps from day one by conducting accurate, comprehensive inspections, preserving evidence, and proactively preparing your claim—giving you leverage and better control over the process.

Understanding Public Adjusters & ICRS Services

What does a public adjuster do, and how is ICRS different from an insurance company adjuster?

A public insurance adjuster works for you, the policyholder—not the insurance company. ICRS exclusively represents commercial and multifamily property owners to document, present, and negotiate large loss property damage claims. Unlike insurer-employed adjusters, we advocate only for your best interest to help ensure you receive a fair and full insurance settlement.

If your commercial or multi-family property has been damaged, taking the right steps immediately can protect your claim and maximize your settlement.

Understand Your Policy Obligations

Your insurance policy outlines specific duties you must fulfill after a hail loss, including documenting damage, preventing further loss, and filing your claim promptly.

Act Quickly to Minimize Risk & Liability

Delays in addressing damage can lead to increased repair costs and insurance disputes. Moisture intrusion, structural weakening, and further exposure can jeopardize your claim.

Don’t Let the Insurance Company Dictate Your Settlement

Insurance carriers may undervalue, delay, or deny claims. If you're not getting the answers you need, seek professional claim assistance to ensure you receive the full payout you’re owed.

Get Expert Help Now

Our large-loss public adjusters specialize help policyholders navigate complex insurance policies and recover maximum settlement you deserve. Schedule Your Free Claim Review Today.

Can’t my contractor or property manager handle the claim?

Navigating a large commercial property insurance claim is complex. Most property managers and management companies simply don't have the expertise to handle a complex large loss claim. Settling large-loss property damage insurance claims require expert knowledge of insurance policy language, construction estimating, negotiations, and claim documentation. While contractors may be involved in repairs or general oversight, they are not licensed or authorized to interpret insurance policies or negotiate claim settlements on your behalf. Doing so may constitute the Unauthorized Practice of Public Adjusting (UPPA), which is prohibited in many states. We work in tandem with your contractor, not in place of them. Public adjusters are the only professionals licensed to represent policyholders in the preparation, documentation, valuation, and negotiation of insurance claims. At ICRS, our licensed public adjusters bring deep expertise in policy interpretation, damage assessment, and insurance negotiations—ensuring your claim is properly presented and maximized under the terms of your policy. Contractors focus on physical repairs—not policy coverage. By contrast, ICRS works to help ensure you receive every dollar you're entitled to before repairs begin, helping you avoid underpayments, scope limitations, or denied benefits that can affect your bottom line.

What experience does ICRS have with large commercial and apartment property claims?

ICRS has successfully handled over 500 large loss claims across the U.S., specializing in commercial buildings and multifamily apartments affected by fire, hail, hurricane, tornado, and water damage. Over 90% of claims are resolved without unnecessary litigation or appraisal.

What types of property damage claims does ICRS handle?

We handle a wide range of commercial property losses including:

• Hail damage

• Fire and smoke damage

• Hurricane and windstorm damage

•.Water damage from pipe bursts

• Tornado, Hurricane and storm impact

• Business interruption losses

What does “no recovery, no fee” mean?

ICRS offers risk-free representation. We only get paid if you do. Our contingency fee model means there are no upfront costs. If we don’t secure a settlement, you owe us nothing.

What qualifies as a "large-loss" claim?

A large-loss claim typically refers to insurance claims exceeding $250,000 in property damage, often involving commercial buildings, multi-family properties, and high-value assets affected by severe weather events such as fire, hailstorms, hurricanes, and tornadoes.

Key Factors That Define a Large-Loss Claim:

Significant Structural Damage – Roof destruction, window breakage, water intrusion, and facade impact.

Widespread Property Loss – Multiple buildings, large commercial facilities, or apartment complexes.

Extensive Business Interruption – Loss of revenue due to operational shutdowns caused by storm damage.

Complex Claim Negotiations – Insurers often dispute the full extent of large-loss claims, requiring expert representation.

Why Acting Fast Matters

Understanding your contractual obligations as a policyholder and the responsibilities your insurance provider owes you is crucial to avoiding unnecessary liability and risk. If your insurance company is delaying or undervaluing your claim, don’t wait.

Need Expert Help? Our large-loss claim specialists ensure you recover the full compensation you deserve. Schedule a Free Claim Review Today.

What if my insurance claim was underpaid?

If your insurance company didn’t pay enough to cover the full extent of your damage repairs, you’re not alone. Insurance carriers often undervalue claims, misclassify damage, or use loopholes to reduce payouts. However, you have options to fight for the compensation you deserve.

How Do Insurance Companies Underpay Insurance Claims?

• Lowball Estimates – Insurers often undervalue repair costs, leaving property owners paying out of pocket.

• Improper Damage Assessments – Adjusters may overlook structural issues or claim damage is "cosmetic" to reduce payouts.

• Unsubstantiated "Expert" Opinions -Sometimes experts who are retained by insurance companies, formulate opinions that may not be credible, it's important to know the difference and how to question opinions vs. facts.

• Depreciation & Policy Exclusions – Some policies factor in wear and tear to justify lower settlements.

How to Fight Back & Recover What You’re Owed

• Get an Independent Claim Review – A second opinion from an expert public adjuster or claims specialist can uncover missed damages and undervalued repairs.

• Demand a Reassessment – You have the right to challenge your insurance company’s payout if it doesn’t align with policy coverage.

• Work Insurance Hail Claim Experts – Professionals who specialize in large-loss hail claims can negotiate for a higher settlement and ensure you’re fully compensated.

Don’t Let the Insurance Company Shortchange You

Understanding your policyholder rights is key to protecting your property and financial investment. If your insurer isn’t paying what they owe, take action now. The longer you wait, the harder it becomes to dispute the claim.

Need Help? Our team of Pro-Policyholder insurance claim specialists have helped policyholders recover millions. Get a Claim Review Today.

Can I dispute my insurance claim payout?

Yes, if you believe your insurance company has undervalued, delayed, or denied your damage claim, you have the right to dispute the payout. Many policyholders face lowball settlements, overlooked damage, or improper claim denials, but there are steps you can take to fight for the compensation you deserve.

When Should You Dispute an Insurance Claim?

• The insurance company did not account for all damages to your roof, windows, or exterior.

• Your payout is significantly lower than contractor estimates for necessary repairs.

• The insurer claims pre-existing damage or uses policy loopholes to reduce the settlement.

• The claim process has been delayed or denied without a clear explanation.

How to Dispute an Underpaid or Denied Damage Claim

1. Review Your Policy – Check your policy to understand your coverage limits, deductibles, and exclusions.

2. Get a Second Opinion – A licensed public adjuster or independent roofing expert can assess whether your damages were fully accounted for.

3. Request a Reassessment – You can formally dispute the insurer’s estimate by providing additional documentation and requesting a second inspection.

4. File an Appraisal or Appeal – Many policies allow for an appraisal process, where a neutral third party helps settle claim disputes.

5. Seek Professional Assistance – If your claim is still undervalued, a claims advocate or legal expert can negotiate on your behalf.

Take Action Before It’s Too Late

Insurance companies may set deadlines for disputing claims, so it’s important to act quickly. If your hail damage claim was underpaid, do not settle for less than you are owed. Our team of hail claim specialists has helped policyholders recover full payouts.

Request a Free Claim Review Today.

Do I need a public adjuster if I have already received my settlement?

Yes, even if you have already received a settlement, a public adjuster can help determine if you were underpaid and whether you are entitled to additional compensation. Insurance companies often undervalue claims by overlooking damages, applying depreciation, or using restrictive policy interpretations. If your settlement does not fully cover the cost of repairs, you still have options.

Why Hire a Public Adjuster After Receiving a Settlement?

Settlement Review – A public adjuster can analyze your claim to ensure the insurance company accounted for all damages and provided a fair payout.

Supplemental Claims – If additional damage is found or your initial payout was insufficient, a public adjuster can negotiate for a higher settlement.

Reopening a Claim – Many policies allow claims to be reopened within a certain time frame, especially if new damages become evident.

Independent Damage Assessment – Insurance adjusters work for the insurance company, while a public adjuster represents your best interests.

When Should You Consider a Public Adjuster?

• Your settlement does not fully cover repair costs.

• You suspect the insurance company undervalued or missed damage.

• You were told certain damage is not covered, but you are unsure if that is accurate.

• You want an expert to handle negotiations and maximize your recovery.

Its best to act quickly with the best support by your side.

Insurance policies often have strict deadlines for filing supplemental claims or reopening a claim. If you believe your settlement was too low, consulting a public adjuster could help you recover the full amount you are owed.

How to Vet a

Good Public Adjuster vs. a Bad One

Do you have a Public Adjuster Checklist for Commercial & Apartment Property Owners?

Yes. Use this list before hiring a public adjuster to ensure you’re working with a qualified, ethical, and experienced professional.

1. Licensing & Credentials

• Is the adjuster licensed in your state?

• Can they provide their license number?

• Are they listed on your state’s Department of Insurance site?

2. Large Loss Experience

• Do they have a track record with claims over $250,000?

• Can they show real case studies or references for commercial/apartment claims?

• Are they familiar with policies involving business interruption, ordinance & law, etc.?

3. Transparent Fee Structure

• Do they clearly explain their contingency fees or flat rates?

• Are there no upfront fees for large losses (except optional consults or retaining experts)?

• Is “no recovery, no fee” included in writing?

4. Communication & Process

• Did they explain the full claims process upfront?

• Are they responsive and professional in all communications?

• Will they provide regular updates on your claim?

5. Legal & Ethical Standards

• Do they strictly handle claim documentation and negotiation, not repairs?

• What percent of their claims escalate to legal or appraisal?

• Do they work alongside your contractor or attorney—not replace them?

• Do they avoid pressuring you into immediate commitments?

6. Reputation & Trustworthiness

• Do they have positive reviews on Google, BBB, or industry platforms?

• Do they have a professional website with real people, contact info, and active business presence?

• Can they provide references from previous clients?

7. Commercial Specialization

• Do they specialize in commercial and multifamily claims?

• Do they understand tenant displacement, loss of rents, and depreciation issues?

• Do they have any roof, water, or fire damage certifications?

Claim Process & Documentation

What documents do I need to provide to get started?

We typically request your insurance policy, loss notice or claim number, damage photos, and any estimates or correspondence with your insurer. We also offer a complimentary online claim review to assess your situation quickly.

How long does it take to settle a large loss claim with ICRS?

Each case varies, but most large loss claims settle within a few weeks to several months. We work efficiently to document damages thoroughly and communicate with your insurer to avoid delays.

Does ICRS conduct its own inspection?

In most cases, we conduct independent site inspections, use advanced damage documentation tools, and collaborate with engineers or contractors when needed. This ensures your claim is supported with strong evidence.

How will ICRS communicate with me during the process?

We provide clear, frequent updates via email, phone, or virtual meetings. You’ll always know the status of your claim and can rely on responsive service from our licensed professionals.

Settlement & Fees

Will hiring ICRS increase my insurance payout?

While results vary, policyholders working with ICRS often receive significantly higher settlements than those who handle claims alone. Our expertise helps uncover overlooked damages and policy entitlements.

Will involving ICRS delay the claim process?

No. In fact, our proactive approach often accelerates the process by submitting fully documented claims that insurers can’t easily dispute or delay.

Are there any upfront costs?

No upfront fees are required for claims over $250,000 for our representation services. For smaller losses, we offer a flat-fee consultation starting at $250. Otherwise, our compensation is contingency-based: no recovery, no fee.

What if the insurer underpays or denies my claim?

We fight for a fair settlement. If needed, we assist in challenging underpaid or denied claims through supplemental requests or appraisal. We aim to settle without unnecessary litigation whenever possible.

Technical & Legal Concerns

Can ICRS help if I already received a partial payment from the insurer?

Yes. If you feel your payout was low or if damages were missed, we can review the claim and pursue additional compensation through a supplemental claim.

Does ICRS provide legal representation or file lawsuits?

No. We are not attorneys and do not litigate. However, our goal is to resolve claims without unnecessary litigation. If legal help becomes necessary, we can refer you to qualified property insurance attorneys.

Can I still use ICRS if I’ve already hired a contractor or consultant?

Yes. We frequently collaborate with contractors, consultants, and engineers. Our role is to manage the insurance side of the claim—not replace your repair team.

What should I avoid doing when dealing with the insurance company?

Avoid giving recorded statements, signing premature releases, or accepting offers without a full damage evaluation. Contact ICRS for a free policyholder consultation before making major decisions.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

AGENCY PUBLIC ADJUSTER LICENSES

MISTY'S PUBLIC

ADJUSTER LICENSES

SCOTT'S PUBLIC ADJUSTER LICENSES

Our Large Loss Specialties

Contact Us

LEGAL

Copyright 2025. ICRS LLC. All Rights Reserved.